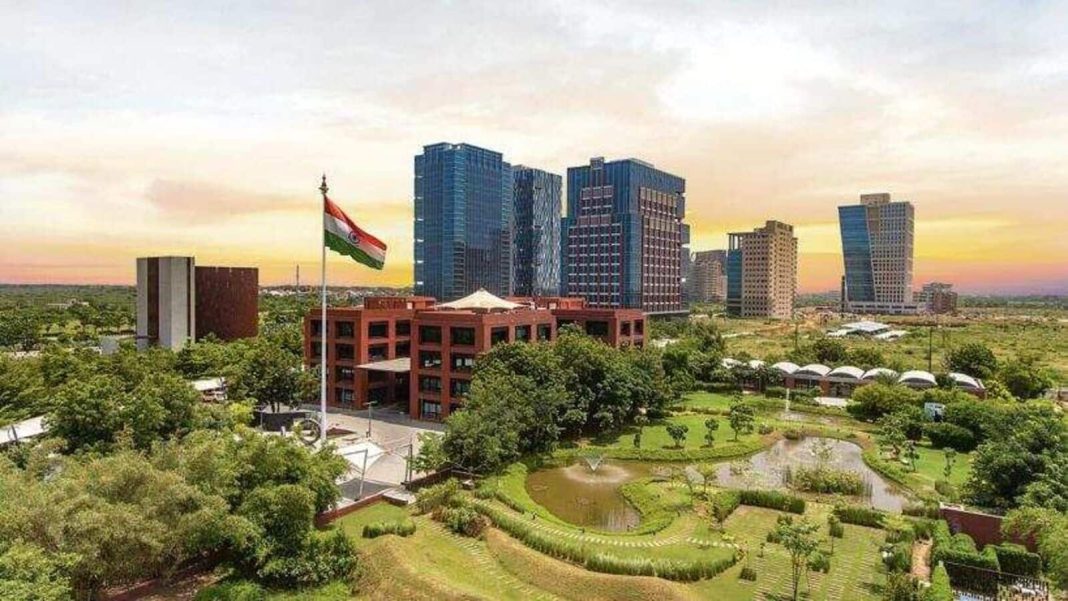

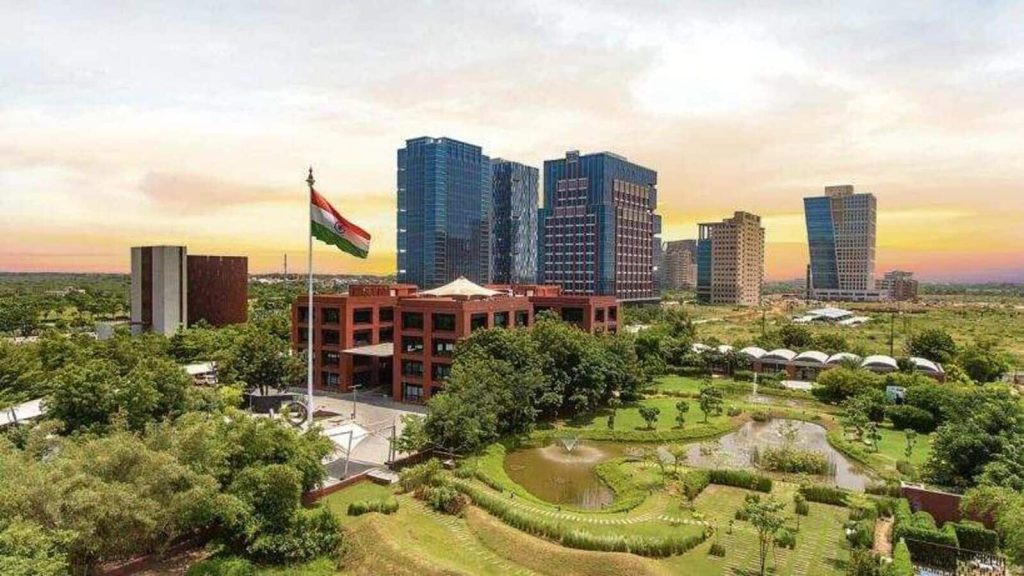

Situated near the banks of the Sabarmati River in Gujarat, the Gujarat International Finance Tec-City, fondly known as GIFT City, is a transformative initiative in India’s financial landscape. Envisioned as a global hub for financial services, this 886 acres of meticulously planned development symbolizes India’s ambitious stride towards becoming an influential player in the world’s financial sector.

At the heart of GIFT City lies the International Financial Services Centre (IFSC). The IFSC serves as a bridge connecting the financial markets of the East and the West, operating in a competitive, conducive, and regulated environment. Offering an array of financial products and services, the IFSC within GIFT City stands as a testament to India’s progressive financial policy reforms.

One of the significant highlights that make the IFSC in GIFT City a global contender in the financial services sector is its competitive tax regime. Designed to attract both domestic and international investors, this innovative tax structure is pivotal to GIFT City’s growth and is a cornerstone in shaping India’s financial future. The forthcoming sections of this article will delve deeper into the specifics of the tax benefits and incentives offered by GIFT City, unravelling the allure of this financial powerhouse.

GIFT City: A Tax Haven for Companies

Table of Contents

In the evolving financial landscape of India, GIFT City emerges as a lucrative haven for companies eyeing to capitalize on a plethora of tax benefits. The key tax advantages offered by GIFT City create a vibrant ecosystem that propels financial growth and fosters business development, both domestically and internationally.

A Reprieve from MAT and AMT

One of the standout benefits for companies operating in GIFT City, particularly within its IFSC, is the exemption from the Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT). These exemptions apply to companies that align with the new tax regime. MAT and AMT, often viewed as a financial burden for businesses, are designed to ensure that all profitable companies pay a minimum amount of tax, irrespective of deductions. By providing an exemption from these taxes, GIFT City allows companies to substantially reduce their tax liabilities, thus improving their bottom line and making them more competitive on a global stage.

Capital Gains Tax Holiday for Aircraft Leasing Companies

In an effort to propel India as a prominent player in the global aviation finance market, GIFT City provides a tax holiday on capital gains for aircraft leasing companies. Furthermore, these companies also benefit from an exemption on tax for aircraft lease rentals. This significant financial incentive is set to attract international aircraft leasing companies to establish their operations in GIFT City, thereby bolstering India’s standing in this niche yet vital sector.

GST Exclusion on Services

In an already impressive array of tax benefits, another highlight is the exclusion of Goods and Services Tax (GST) on services provided by companies within the IFSC to other units in the same SEZ or offshore clients. In the financial services sector, where services often form the core of business operations, this GST exclusion provides a significant cost advantage. Consequently, this reduction in operational costs not only enhances business profitability but also makes GIFT City an attractive destination for companies seeking to expand their footprint in Asia.

Collectively, these tax benefits underscore GIFT City’s commitment to fostering a conducive and profitable business environment. The strategic implementation of these incentives sets the stage for GIFT City’s transformation into a global financial hub, marking an important milestone in India’s economic growth narrative.

State Subsidies Enhancing the Allure

In addition to the favourable tax regime, GIFT City further enhances its appeal to businesses through a range of state subsidies. These subsidies, designed to reduce operational costs, make GIFT City an even more attractive destination for businesses of all sizes.

Stamp Duty, Registration Fee, and Electricity Duty Reimbursements

The State Government offers 100% reimbursement on stamp duty and registration fees on the transfer of land and office space. This significant relief in costs is especially beneficial for new entrants looking to establish their operations within GIFT City. Moreover, businesses also enjoy 100% reimbursement on electricity duty, further reducing their operational overheads.

Subsidized Power Tariff

Understandably, for businesses large and small, utility costs, particularly electricity, can form a considerable chunk of operational expenses. To alleviate this, GIFT City offers an Rs. 1 subsidy on power tariff for a duration of five years. This subsidy can result in substantial savings over time, making it financially easier for businesses to set up and grow their operations in the city.

Provident Fund Contributions and Lease Rental Subsidies

Employers within GIFT City benefit from a 100% reimbursement on their contribution to the provident fund. This reimbursement is a boon for companies as it helps lower their financial obligations towards employee benefits. Additionally, the city offers a lease rental subsidy for every 50 sq ft per employee, making it cost-effective for businesses to provide for their workforce’s office space needs.

In conclusion, these state subsidies, along with the tax incentives, work in tandem to create an environment that not only attracts businesses but also encourages their growth and expansion. By reducing costs and eliminating barriers, GIFT City is fast becoming a global hub for financial services, setting the stage for India’s ascent in the global financial landscape.

Exemptions for National/Foreign Exchanges

Further enhancing the financial allure of GIFT City, the International Financial Services Centre (IFSC) offers a wealth of tax exemptions for national and foreign exchanges set up within its boundaries. These exemptions are designed to boost the competitiveness of these exchanges and stimulate the financial market’s growth.

The tax benefits granted are all-encompassing and include exemptions on an array of transactional taxes. They encompass Security Transaction Tax (STT), Commodity Transaction Tax (CTT), Dividend Distribution Tax (DDT), Long Term Capital Gain Tax (LTCG), and Short Term Capital Gain Tax (STCG).

Security Transaction Tax (STT) and Commodity Transaction Tax (CTT) are usually levied on the trade of securities and commodities respectively. These taxes can add up to significant amounts for exchanges, and their exemption provides a substantial financial benefit.

Dividend Distribution Tax (DDT), which is a tax levied on the dividends distributed by a company to its shareholders, is also exempt in the GIFT City. This exemption stimulates more active trading by reducing the overall tax burden for investors.

In addition, the exemption on Long Term Capital Gains (LTCG) and Short Term Capital Gains (STCG) taxes encourages investment by reducing the tax implications of trading profits, thereby promoting a more active and vibrant exchange.

These extensive tax exemptions for exchanges operating in GIFT City’s IFSC offer a compelling financial incentive that not only attracts national and foreign exchanges but also promotes a more dynamic and competitive trading environment. These benefits underscore GIFT City’s strategic importance in propelling India onto the global financial stage.

GIFT City: An Emerging Global Financial Hub

In an era where global financial hubs are vying for supremacy, GIFT City, with its robust framework of tax incentives, emerges as a formidable player. These incentives play a significant role in attracting substantial domestic and foreign investments, propelling GIFT City’s ascent in the global financial arena.

The array of tax benefits offered by GIFT City and its International Financial Services Centre (IFSC), ranging from exemptions from Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT), to GST exclusions and a variety of state subsidies, have set a compelling stage for both domestic and international businesses. Such a tax-friendly environment enables companies to maximize their profits, thereby making GIFT City an increasingly attractive destination for investment.

Moreover, the total tax exemption for national and foreign exchanges set up within the IFSC has created a fertile ground for vibrant and competitive trading. This provision is catalyzing the growth of GIFT City as a buzzing nexus for financial transactions, akin to well-established financial centres like Singapore and Hong Kong.

The culmination of these tax incentives has been pivotal in attracting significant foreign investment. As per reports, GIFT City has attracted more than INR 2 lakh crores (approx USD 27 billion) in investments, underscoring its rapidly growing stature as an international financial hub.

In addition to attracting investments, these incentives have also fostered a conducive business environment for startups and established enterprises alike. This, in turn, has led to the creation of numerous job opportunities, further contributing to the city’s economic growth.

In conclusion, the tax incentives in GIFT City have proven to be an effective tool in transforming it into an emerging global financial hub. Through its strategic offerings, GIFT City is not only solidifying India’s position in the global financial landscape but also contributing to the country’s economic growth story. As GIFT City continues to evolve and grow, it is set to redefine the dynamics of the financial services sector globally.

GIFT City, strategically located in Gujarat, India, is more than a mere testament to India’s progressive financial vision. It represents a blueprint for future financial hubs, driven by a robust framework of tax incentives that foster business growth and attract substantial domestic and foreign investment.

From exemptions on MAT and AMT for companies operating under the new tax regime, to tax holidays for capital gains of aircraft leasing companies and GST exemptions, GIFT City presents a competitive edge in the global financial marketplace. Further supplemented by state subsidies, including reimbursements of stamp duty, registration fee, and electricity duty, as well as provident fund contribution reimbursements, GIFT City ensures a cost-effective environment for businesses.

Furthermore, GIFT City’s International Financial Services Centre (IFSC) offers comprehensive tax exemptions for both national and foreign exchanges. This reflects GIFT City’s dedication to fostering a thriving trading environment, positioning it as an appealing destination for start-ups from Ahmedabad and beyond. Such policies play a pivotal role in cultivating a competitive ecosystem that champions active trading and encourages overall market growth.

These tactical tax benefits have accelerated GIFT City’s evolution, morphing it into an emerging powerhouse in the global financial sphere. GIFT City stands as a shining beacon of India’s economic capabilities and the government’s aspiration to reinforce the nation’s status as a leading financial hub in Asia. With a substantial influx of investment, a list of incubators in Ahmedabad endorsing GIFT City, and an amiable environment for businesses, GIFT City is on the fast track to reshaping India’s financial landscape, paving the way for a promising future.

As we look forward, GIFT City’s promising trajectory reaffirms its role as a catalyst for India’s financial revolution. As GIFT City continues to mature and evolve, these tax incentives will remain key drivers of its development, shaping its future prospects and cementing its place as a global financial hub.